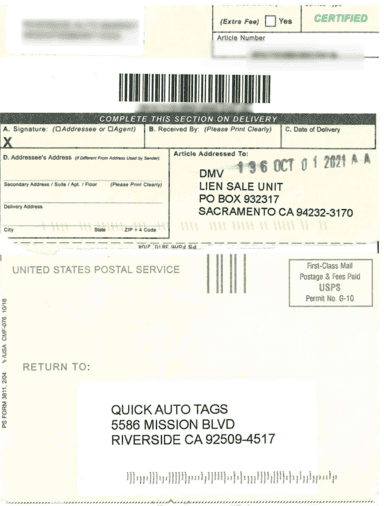

Bonded titles are often used in vehicle transactions, particularly when the original title of a vehicle is missing, lost, or damaged. This situation can arise when purchasing a vehicle without proper documentation or in cases where the title has been lost over time.

This article will explain what bonded titles are, what triggers the need to get a bonded title, what process is required PRIOR to obtaining a defective title bond, how much a surety bond costs & finally where to obtain a defective title bond.

Important note: there is a distinction between the purchase of the bond, and, the paperwork, fees, and procedures for obtaining a defective title bond – they are connected but they are separate.